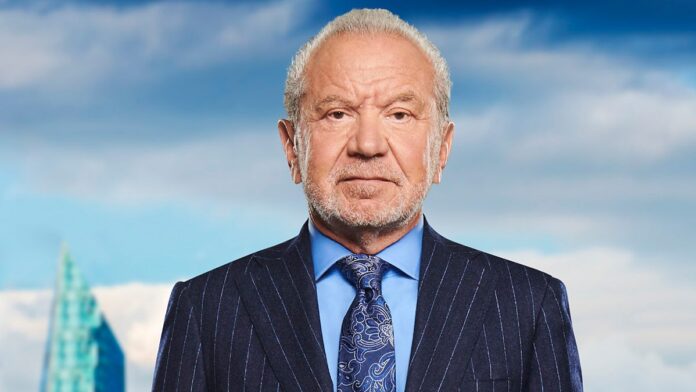

The House of Lords brings many perks, but one thing it can’t help you with is tax avoidance, as Lord Sugar recently found out to his cost!

Lord Sugar has been living in Australia, and thought he had escape the £186 million tax bill on his £390 million dividend paid by Amshold Group Limited his private holding company. But despite being a non-resident he is still a Lord and therefore what he pays is stipulated in the Constitutional Reform and Governance Act 2010. Members of both houses of parliament are automatically deemed to be UK resident and liable for income tax, inheritance, and capital gains taxes.

Fair to say Lord Sugar is reportedly not too happy with the advice he got from the professionals!

When Lord Sugar got in a spat over his advice not to vote for Jeremy Corban in 2017, he tweeted a picture of the £59 million cheque he personally sent the taxman. We are not sure he will be posting his new tax payment any time soon.