October 2020

Mushtaq Ahmed looks at how the cash accounting scheme works

Bridge experience gap between AAT theory and practice

with Future Connect Training at: fctraing.org/aat.php

What is Cash Accounting Scheme?

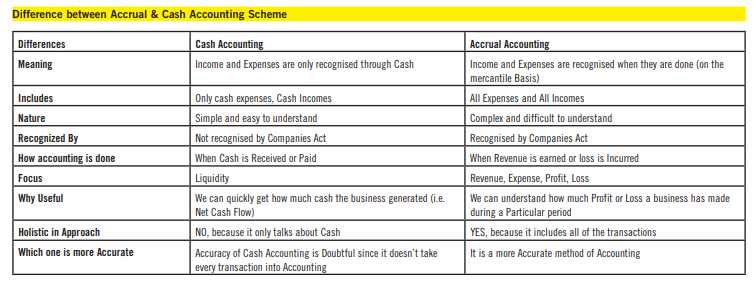

• The Cash Accounting VAT Scheme is a method of reporting VAT on the basis of payments made or received. (Debitoor.com)

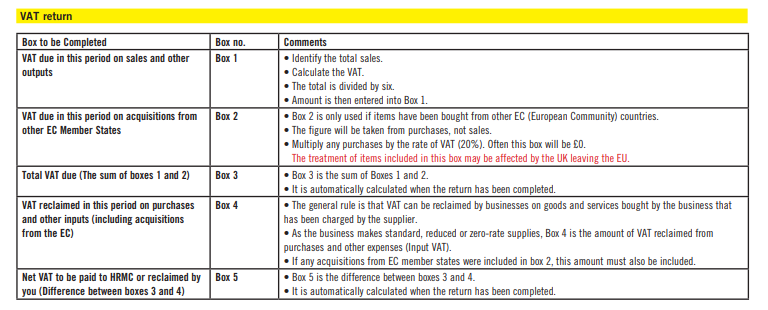

• Usually, the amount of VAT you pay HM Revenue and Customs (HMRC) is the difference between your sales invoices and purchase invoices.

With the Cash Accounting Scheme, you:

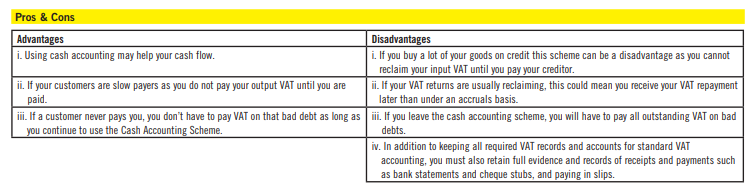

i. pay VAT on your sales when your customers pay you

ii. reclaim VAT on your purchases when you have paid your supplier

How to join:

• You must be eligible to join the scheme.

• You join at the beginning of a VAT accounting period.

• You don’t have to tell HM Revenue and Customs (HMRC) you use cash accounting (Gov.uk.).

How to leave:

• You can leave the scheme at any time.

• You must leave if you’re no longer eligible to use it, leave at the end of a VAT accounting period.

• You must report and pay HMRC any outstanding VAT (whether your customers have paid you or not).

• You can report and pay the outstanding VAT over 6 months.

• If your VAT taxable turnover exceeded £1.35 million in the last 3 months you must report and pay straight away.

• You must pay immediately if HMRC has written to you to withdraw your use of the scheme.

You are eligible for cash accounting if:

• Your business is registered for VAT.

• Your estimated VAT taxable turnover is £1.35 million or less in the next 12 months.

• You must leave the scheme if your VAT taxable turnover is more than £1.6 million.

You can’t use (exceptions) cash accounting if:

• You use the VAT Flat Rate Scheme – instead, the Flat Rate Scheme has its own cash-based turnover method.

• You’re not up to date with your VAT Returns or payments.

• You’ve committed a VAT offence in the last 12 months, for example VAT evasion.

You can’t use it for the following transactions use standard scheme instead:

• Where the payment terms of a VAT invoice are 6 months or more.

• Where a VAT invoice is raised in advance.

• Buying or selling goods using lease purchase, hire purchase, conditional sale or credit sale.

• Importing goods from within the EU.

• Moving goods outside a customs warehouse.

• Mushtaq Ahmed is the accounts training manager at Future Connect Training