January 2022

This is a subject you really need to know inside out and back to front, says our AAT guru Teresa Clarke.

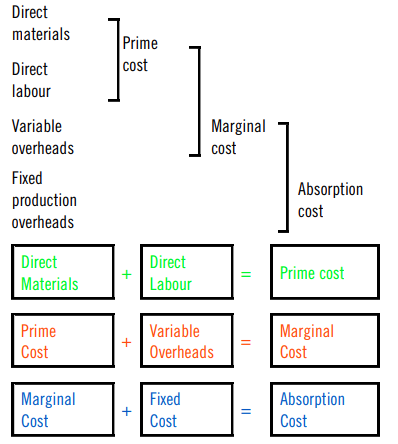

Marginal costing is based on the variable costs of production and does not include any fixed costs.

Absorption costing includes both the variable, or direct costs, and the fixed costs, or indirect costs, of production.

Note that marginal costing is not permitted in financial reporting, but absorption costing is permitted. Both methods can be used in management accounting.

Let’s look at some definitions:

Prime cost: This is the direct labour and direct material only.

Prime means first, so this is just the direct labour and direct material to make the item.

If no products are made, then no prime costs are incurred.

Marginal cost: This is calculated by adding the prime cost and the variable production overheads.

Marginal means part of, so this is the prime cost and the variable production overheads added together.

If no products are made, then no marginal costs are incurred.

Absorption cost: This is calculated by adding

the marginal cost and the fixed production overheads.

Absorption absorbs all production overheads associated with making a particular product.

Remember: We are only looking at the production overheads here and are not interested in anything else, such as office expenses, admin costs, selling expenses or insurance.

Example

Sivam Ltd has asked you to prepare some costs for their new designer table. the marginal cost per unit and the absorption cost per unit.

You have been provided the with following details of the planned production of the new table.

Planned Production of 1,000 tables

Sales price per unit = £199.00

Total direct materials = £13,000

Total direct labour = £16,000

Variable cost per unit = £1.80

Total fixed production cost = £65,000

Non-production overheads = £75,000

Prime cost per unit

Direct materials plus direct labour = prime cost.

£13,000 + £16,000 = £29,000. This is the total prime cost.

£29,000 / 1,000 units = £29. This is the prime cost per unit.

Marginal cost per unit

Prime cost, plus variable production overheads = marginal cost.

This is the marginal cost per unit.

£30.80 x 1000 units = £30,800. This is the total marginal cost.

Absorption cost per unit

Marginal cost, plus fixed production overheads = absorption cost.

£30,800 + £65,000 = £95,800. This is the total absorption cost.

£95,800 / 1,000 units = £95.80

Note: The non-production overheads are ignored.

Summary

If you would like to more tips and guides from me please check out my workbooks on Amazon – go to https://tinyurl.com/cmk53vjw