August 2024

Karen Groves has some top tips on how to hone your skills for the Level 3 Financial Accounting: Preparing Financial Statements unit.

This unit is the one our Level 3 students start with. It builds on from your Level 2 ITBK and POBC knowledge, which is assumed knowledge at this stage.

The assessment will test your ability to use advanced bookkeeping skills, carry out adjustments and draft final statements for sole traders and partnerships. You will also need to be able to interpret the financial statements using profitability ratios.

Important note!

If you are not certain that you have started at the correct level for AAT, please go to the link here, which includes questions to assess your knowledge at this stage: https://tinyurl.com/m5aakt64. Now for the assessment debrief and some feedback.

The assessment lasts for 2½ hours, and you will have six tasks to complete. I have broken the tasks down, and flagged the areas where students lose the most marks.

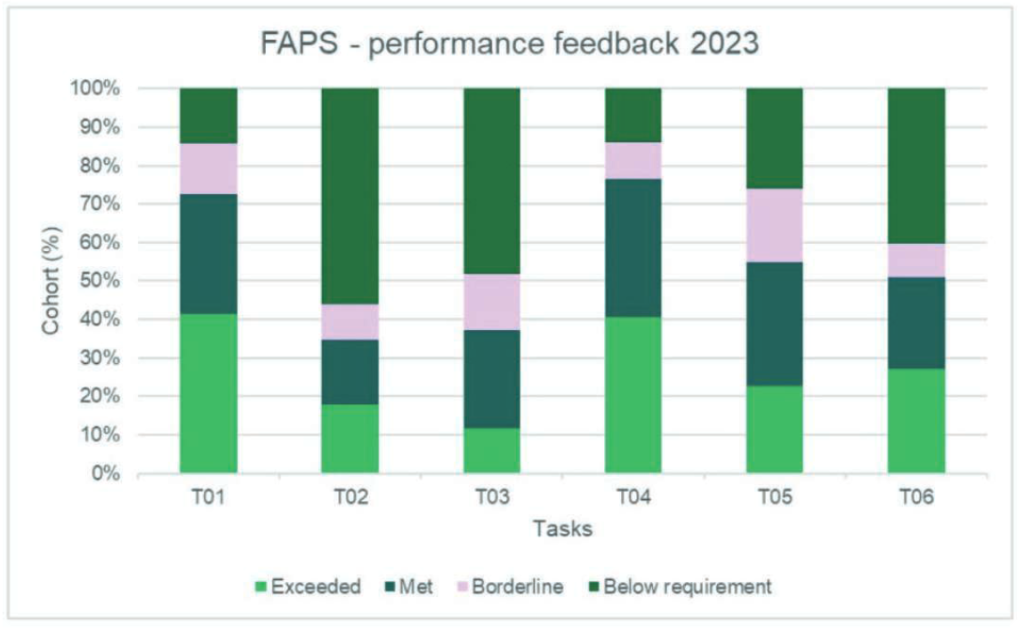

The below screenshot is taken from the AAT Examiner’s guide, which illustrates the tasks where most marks are typically lost:

Task 1 – Using day books and accounting for and monitoring non- current assets

For this task, you need to ensure that you are confident with accounting for disposals in the non-current asset register, recognise the difference between revenue and capital expenditure and the effect on the financial statements of this being entered in the wrong account, and be able to calculate depreciation prior to the disposal of a non-current asset.

Marks are typically lost on accounting for disposals and calculating accumulated depreciation.

Student performance in this task is usually very good.

Task 2 – Recording period end adjustments

My advice here is read the question carefully. You may need to adjust closing inventory, or a re-valuation of closing inventory.

Marks are typically lost on valuing and posting closing inventory, the allowance for doubtful receivables and calculating the amount to be prepaid or accrued where invoices cover two accounting periods.

Accruals and prepayments for income and expenses are a very tricky concept to grasp at first, however you must be confident with this.

Question practice here is crucial if you are to succeed with this topic.

You will find a good question in the AAT practice assessment 2, Task 2, on inventory valuation, so always worth running both practice assessments.

Task 3 – Producing, adjusting, checking and extending the trial balance

Again, read the task requirements carefully. You will need an understanding of the accounting equation and how it changes with each transaction and be able to prepare a bank reconciliation.

Errors, the suspense account and journal entries are a tricky topic, so again lots of question practice is required on this topic.

Areas of weakness in this task include correcting errors, completing a trial balance and a lack of understanding of the accounting equation.

Task 4 – Producing financial statements for sole traders and partnerships

For this task you must be happy with how to prepare financial statements for a sole trader and a partnership.

Marks are lost by students who do not understand how the financial statements link together and the differences between the entries for a sole trader and partnership in the Extended Trial Balance.

Task 5 – Accounting principles, qualities of useful information and interpreting financial statements using profitability ratios

You will need a good understanding of the accounting principles and the application, including the fundamental and enhancing qualitative characteristics, and be able to calculate profitability ratios.

Marks are lost here by students not being able to identify the users of the financial statements and being unable to analyse factors that impact on the profitability ratios.

Task 6 – Preparing accounting records from incomplete records

One of my favourite topics in this unit; in the typical scenario the client brings in limited information, sometimes a shoe box of receipts. However, for AAT purposes the information provided is actually much better than I used to see in the workplace!

Anyway, back to the task. You will need to be able to calculate gross profit from mark-up and sales, purchases and inventory figures. You will need to be able to complete the RLCA and PLCA with confidence, identifying missing account balances, and identify factors that could caus discrepancies between accounting software figures and other balances.

Marks are typically lost on all of the above areas mentioned above, so make sure you are confident with these areas before the exam.

Remember! Read the question carefully, and good luck with your exam!

- Karen Groves is an AAT tutor and AAT Faculty Director at e-Careers