April 2022

Teresa Clarke focuses on how to correct the errors that inevitably happen in accountancy.

In accountancy and bookkeeping errors can happen, so we need to know how to correct those errors.

This topic is particularly relevant to those studying AAT Level 2 Bookkeeping Controls and AAT Level 3 Advanced Bookkeeping.

Some errors are shown by the trial balance when the debits do not match the credits. Other errors are not detected in the trial balance.

Here are names of errors that do not affect the trial balance with an example of each.

Error of omission: A purchase invoice has not been entered into the accounting system at all. Omission means left out.

Reversal of entries: A purchase invoice has been debited to the bank and credited to the purchases account. The credit and debit entries have simply been reversed or put the wrong way around.

Error of original entry: A purchase invoice for £30 was received and was entered as £3 for both the debit and credit entries.

Compensating error: An error in the purchases account on the debit side was £20 too much and an error in the sales account on the credit side was £20 too much. One error compensates the other or simply matches the other.

Error of commission: A purchase invoice for office supplies has been entered in the motor expenses account in error. They are both the same type of account, namely expense accounts.

Error of principle: A purchase of an asset has been entered as an expense in an expense account. These are different types of account.

Here are names of errors that do affect the trial balance, meaning that a suspense account is created for the imbalance, with an example of each.

Single entry error – one sided error: A debit entry has been correctly entered, but no credit entry.

Casting error: A ledger account has been incorrectly totalled. Casting means added-up, so this is an adding-up error.

Transposition error: The numbers in one of the ledger balances have been transposed, so £369 has been entered as £396.

Extraction error: This is when the balance b/d has been taken from the ledger, but the wrong number was extracted or taken out of the ledger.

Two debits or two credits: Two debit entries have been made instead of a debit and credit entry.

Error of omission: One ledger balance has been left out, such as the motor expenses.

NOTE: For Level 2 studies you will need to remember the names of these, but for Level 3 studies you will just need to remember how to correct them.

The suspense account is a temporary account which is created for errors in the general ledger that cause an imbalance in the initial trial balance. A suspense account remains in the trial balance until the error or errors have be found and corrected.

NOTE: The suspense account can have a debit or credit balance.

Example

We can look at an error that involves the suspense account.

Ruby has received a payment from a credit customer and has entered it into the accounting records:

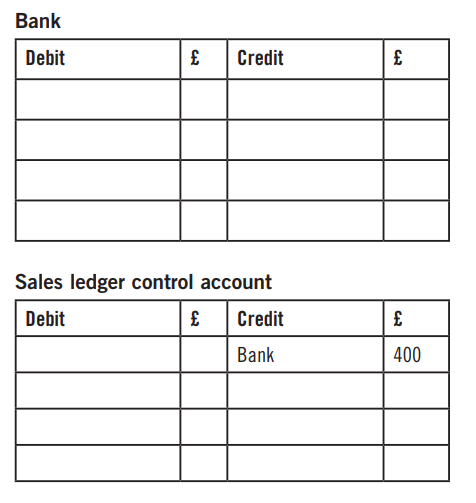

Cr Sales ledger control account £400

No debit entry has been made.

Step 1: Identify the error. Ruby has correctly made the credit entry but has made no debit entry.

Step 2: What entries should have been made. Remember to write your entries as they should have been entered.

Dr Bank £400

Cr SLCA £400

Step 3: Correct the error. The credit entry that Ruby made was correct, so we do not touch that. The error is with the debit entry which was omitted or left out.

REMEMBER: When we correct entries, we always make both a debit and credit entry.

We can look at the entries that Ruby made:

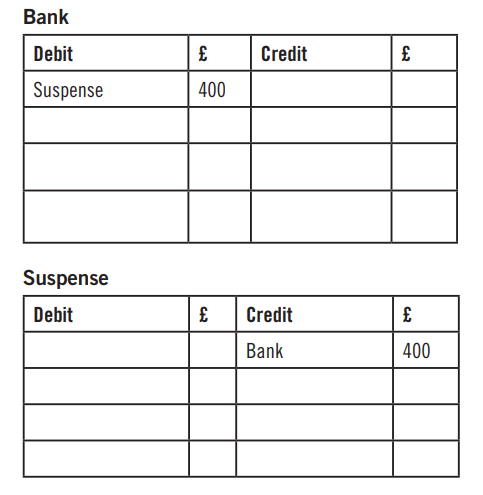

To correct this, we need to debit the bank account with the £400, but we must also make a credit entry somewhere. As the credit entry was already correctly made to the SLCA, we use the suspense account.

This can be written as a journal entry:

Dr Bank £400

Cr Suspense £400

This error has been corrected.

If you wish to further your knowledge on this topic you might like this workbook, which is one of my series of workbooks written to support your studies:

Errors and the Suspense Account, available in paperback for £3.49 or as an eBook for £1.89.

https://www.amazon.co.uk/dp/B08YQCS4HN

• Teresa Clarke FMAA