January 2024

Teresa Clarke explains all you need to know about the statement of profit or loss.

The statement of profit or loss is split into two parts.

The first part known as the trading account giving us the gross profit.

The second part calculates the net profit of the business after expenses have been deducted.

The statement of profit or loss shows the performance of the business over the past accounting period, usually a period of 12 months, to the accounting year-end date.

The statement of profit or loss contains the income and expenses for the business.

The statement of financial position

The statement of financial position is a list of all the assets and liabilities of the business at a given date, usually the last day of the accounting period.

This will be the year-end date of the statement of profit or loss. If the statement of profit or loss is for the year ended 31 March 2022, then the statement of financial position will be dated 31 March 2022.

The statement of financial position shows the business equity, closing capital or net worth at that date. It contains the assets and liabilities.

The statement of profit or loss

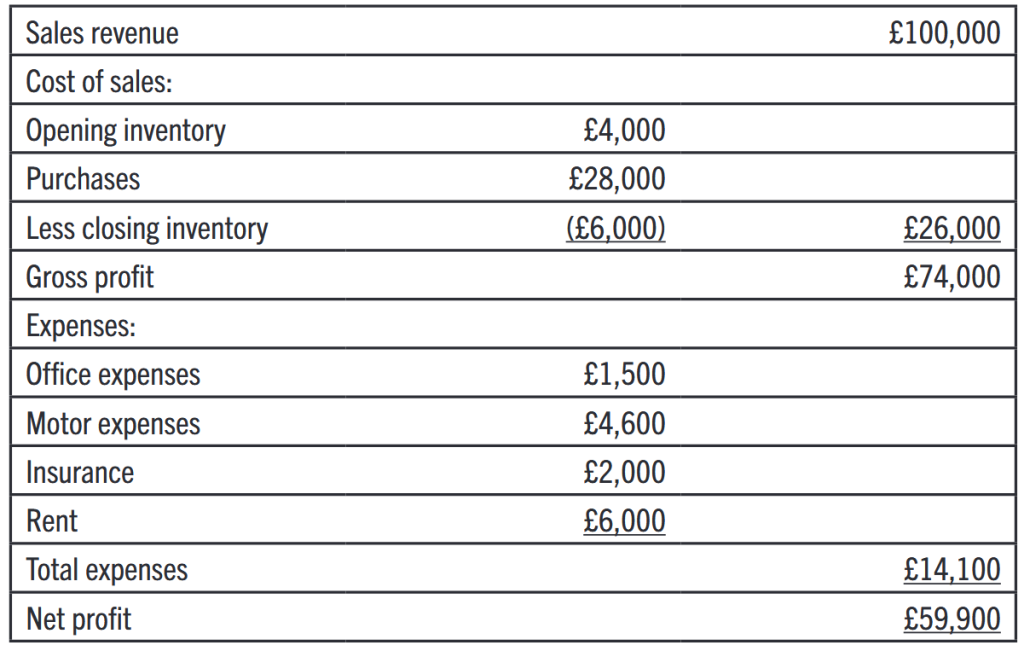

The statement of profit or loss below shows just a few entries. Take a look at this and then read the details that follow to ensure that you understand the statement.

Statement of profit or loss

The sales revenue is the income of the business. This could be the sales made in a shop or invoices sent out to customers. It can be referred to as sales revenue, sales or just income.

The cost of sales is made up of the opening inventory (or opening stock), plus the purchases, less the closing inventory (or closing stock). This represents the cost of earning the income. It can also be referred to as the cost of goods sold.

The cost of sales is deducted from the sales revenue figure to give the gross profit.

If our business was a sweet shop, the sales revenue would be the money taken in sales of sweets. The cost of sales would be the stock of sweets sold.

The expenses are costs incurred in the running of the business and vary from business to business, depending on the trade of the business. The expenses are totalled and then deducted from the gross profit to give the net profit of the business.

(The net profit is the figure used to calculate the tax owed by the sole trader.)

The statement of financial position

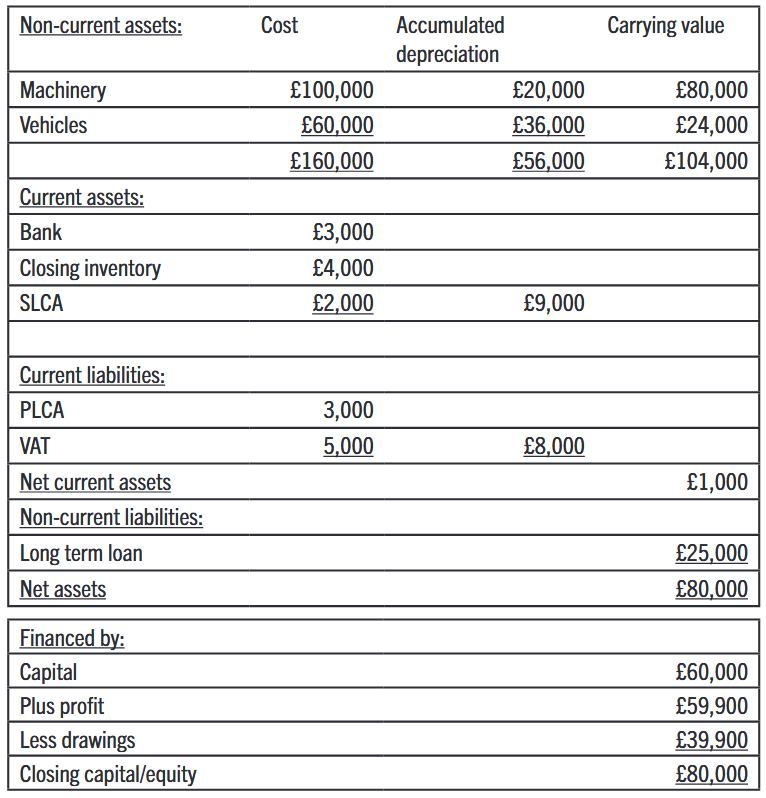

The statement of financial position below shows just a few entries. Take a look at this and then read the details that follow to ensure that you understand the statement.

The statement of financial position

The statement of financial position below shows just a few entries. Take a look at this and then read the details that follow to ensure that you understand the statement.

The statement of financial position

The statement starts with the non-current assets. These are capital items and are shown at their original cost, less their accumulated depreciation. It is the carrying value that we need for this statement.

Current assets are listed next, followed by the current liabilities. Each are totalled and then the current liabilities are deducted from the current liabilities to give us the net current assets figure.

Any non-current liabilities are shown under this, and these are usually long-term loans, mortgages, or other long-term finance.

The carrying value of the non-current assets, plus the net current assets, less the non-current liabilities will give the net assets figure or net worth of the business.

The second half of this statement is the ‘financed by’ or ‘represented by’ section. This is the opening capital, plus the profit of the business (taken from the statement of profit or loss), less any drawings the owner has taken from the business. The final figure should be the same as the net assets figure from the first part of the statement.

- Teresa Clarke is AAT tutor if you like my way of explaining things, you might like my workbooks, which are all available from Amazon in both paperback and as eBooks. The links to all my workbooks can be found at https://www.teresaclarke.co.uk/