April 2023

Our AAT guru Teresa Clarke explains how to account for goodwill when a partnership changes, a topic particularly relevant to those studying AAT Level 3.

Goodwill is the difference between the value of the net assets of a business and the value of the business as a whole. For example, a window cleaning business may only own a bucket and a sponge worth £3.50, but the business could be worth £5,000 to a buyer because of the customer base and reputation.

In a partnership, two partners may have spent 10 years building up a business and if another partner wants to join, they do not want to just give him a share of that goodwill. This is why we share the goodwill between the current partners before the new partner joins and the new partner buys his share of that goodwill.

The same applies when a partner leaves the partnership. They want their share of the goodwill that has built up over the years by the partnership.

The goodwill is shared between the existing partners before the retiring partner leaves taking his share with him, and then the remaining partners ‘buy back’ the goodwill.

Example

Peter and Oksana have a window cleaning business, sharing the profits equally. The goodwill has been estimated to be worth £5,000. Jane wants to join the business and is prepared to invest £2,000 into the business. The new profit share ratio will be 2:2:1 when she joins with Jane receiving the lower share.

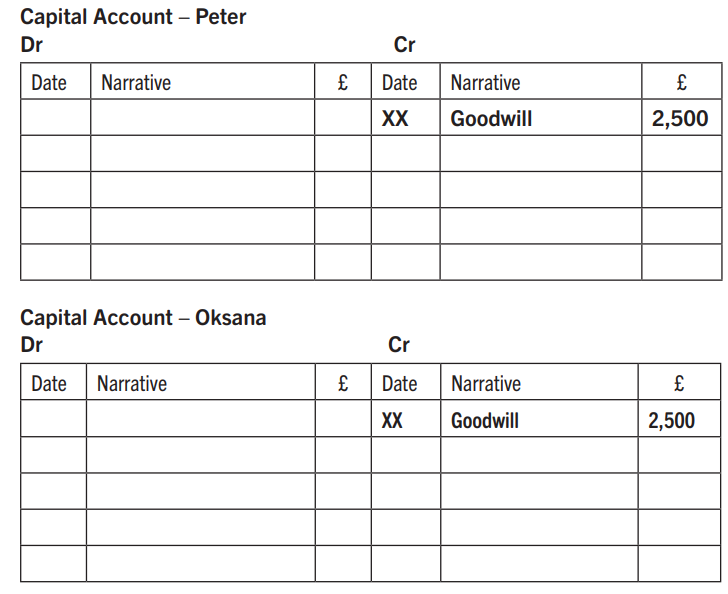

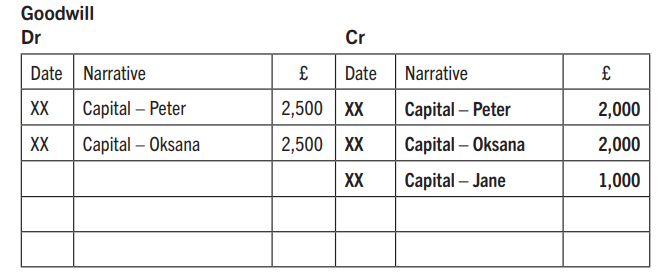

Before Jane joins the business, we must share the goodwill between the existing partners using their current profit share ratio. We give the existing partners their share of the goodwill and add this to their capital accounts.

We are increasing their capital with the goodwill, so these are credit entries in the capital accounts.

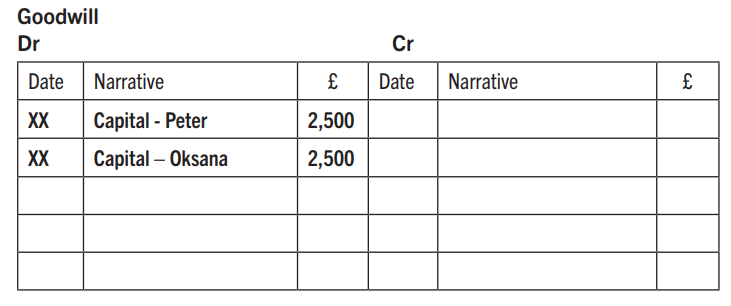

The debit entries go into the Goodwill account which is a temporary account, and no physical money is moved.

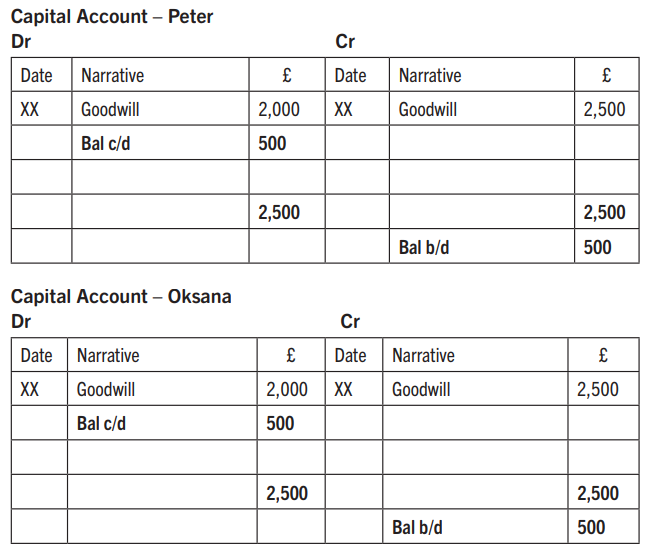

Now Jane can join the business. She deposits her capital into the business bank account.

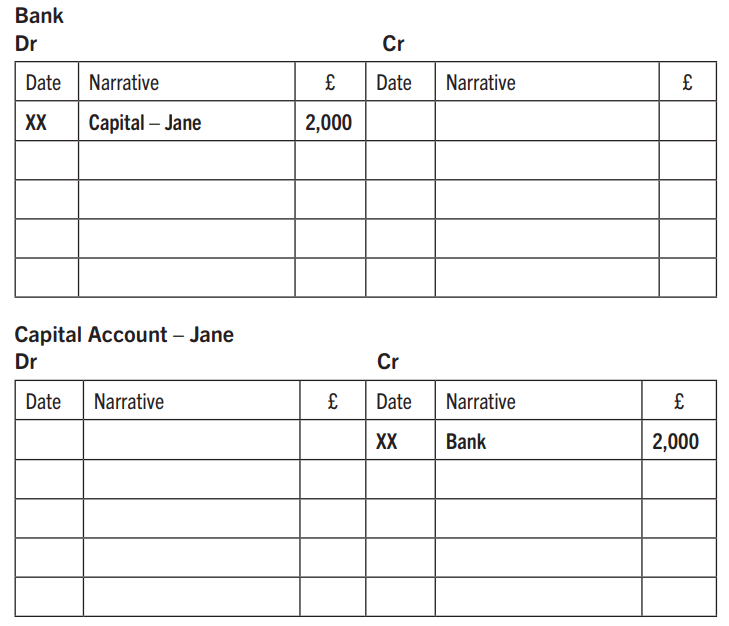

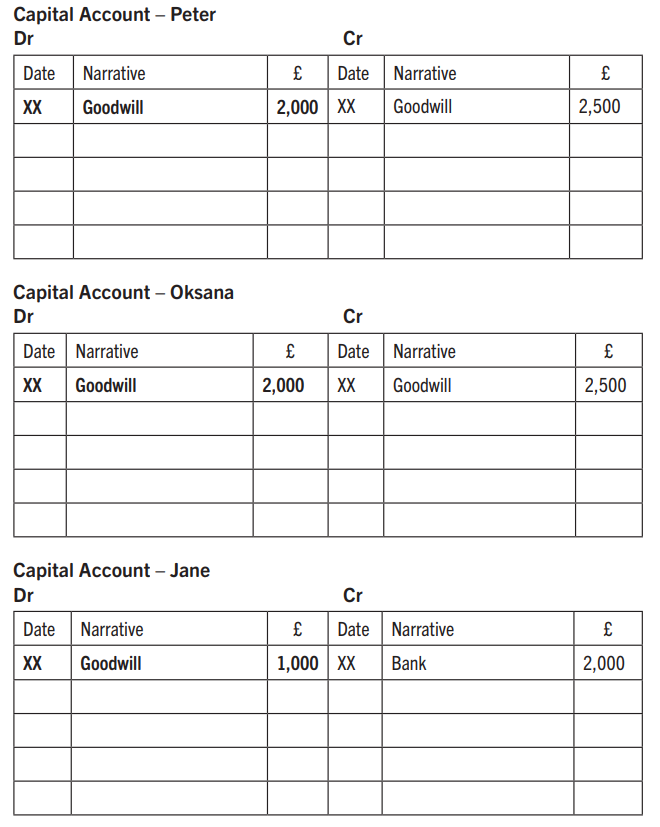

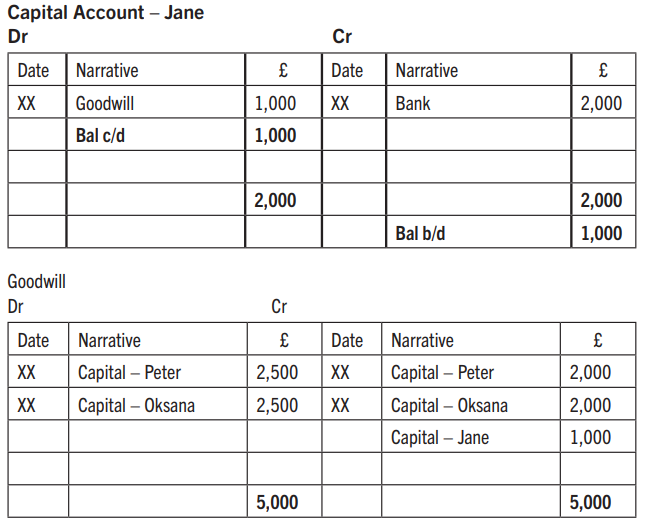

The Goodwill account is only temporary, so we need to eliminate this by sharing this between the new partners, in the new profit share ratio.

The accounts can now be balanced off.

The same step-by-step process is used for a retiring partner.

Use these steps to try some goodwill questions yourself:

1. Draw up a goodwill account and debit this with the goodwill valuation.

2. Debit the goodwill account by sharing it between the existing partners using the profit share ratio and credit this to their capital accounts.

3. Eliminate the goodwill by crediting the goodwill account and debiting the capital accounts using the new profit share ratio.

4. Balance all accounts.

Remember, the goodwill account is a temporary account, no money is physically moved, and the account is always empty when the calculations are complete.

If you like this guide, you might also like my AAT revision workbooks.

Available from Amazon in paperback or as eBooks – see https://tinyurl.com/5e6xatty

- Teresa Clarke FMAAT