January 2024

Karen Groves explains how to approach an overhead absorption exam style question and tests your knowledge on the subject.

Overhead absorption is assessed at AAT Levels 2, 3 and 4, and is therefore a very important part of the syllabus.

Overhead costs are also referred to as indirect costs. These costs need to be spread over the output of the production cost centre to ensure all costs are included. The absorption rate is based on budgeted quantities of the products and will usually be set at the start of a period.

For Level 2 Principles of Costing, students are expected to be able to calculate overhead absorption based on:

- Unit basis – whereby each unit gets the same amount of overhead absorbed.

- Machine hour basis – whereby the overheads are absorbed based on a machine hour.

- Labour hour – whereby the overheads are absorbed based on a labour hour.

The most suitable method would be selected from the above, for example, a highly mechanised business would select machine hour basis, whereas a highly labour-intensive business would select labour hour basis.

We will look at an example question, and the way this should be approached.

Example

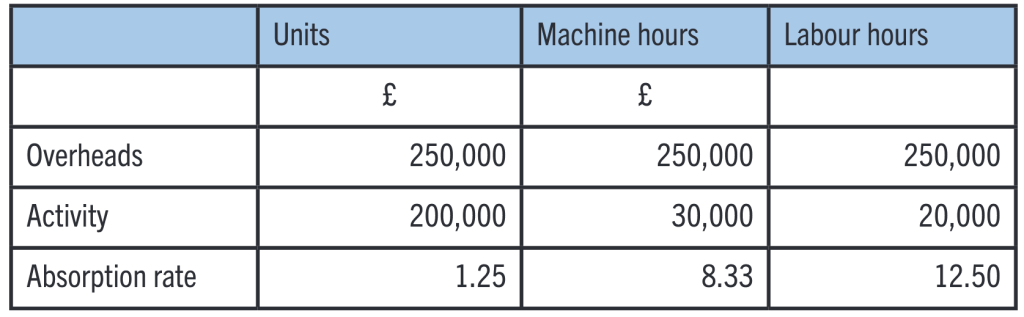

EC Limited are calculating the cost for one product and require calculations for an overhead absorption rate based on rate per unit, rate per machine hour and rate per labour hour as they are considering which method to select.

The activity for November 2023 is as follows:

The absorption rates would be calculated as follows (absorption rate answers to two decimal places):

Calculations:

Overheads £250,000 / 200,000 = £1.25

Machine hours £250,000 / 30,000 = £8.33

Labour hours £250,000 / 20,000 = £12.50

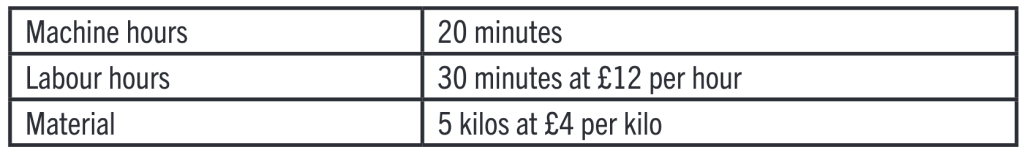

EC Limited have provided you with the following information relating to making one unit:

Using the overhead rates calculated earlier, we can now complete the total unit cost, using the data above:

Calculations:

Material 5 kilos x £4 per kilo = £20.00

Labour hours £12 / 60 minutes x 30 minutes = £6.00

Overheads:

Units £1.25 calculated earlier

Machine hours £8.33 / 60 minutes x 20 minutes = £2.78

Labour hours £12.50 / 60 minutes x 30 minutes = £6.25

Now have a go!

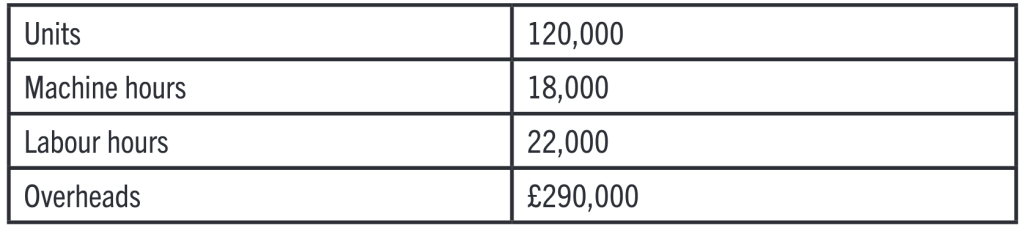

ABC Limited are calculating the cost for one of their products and require calculations for an overhead absorption rate based on rate per unit, rate per machine hour and rate per labour hour as they are considering which method to select.

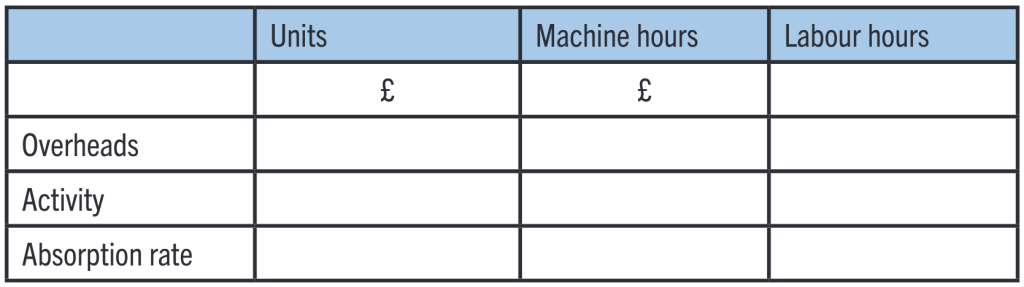

The activity for December 2023 is as follows:

Complete the table below (absorption rate answers to two decimal places):

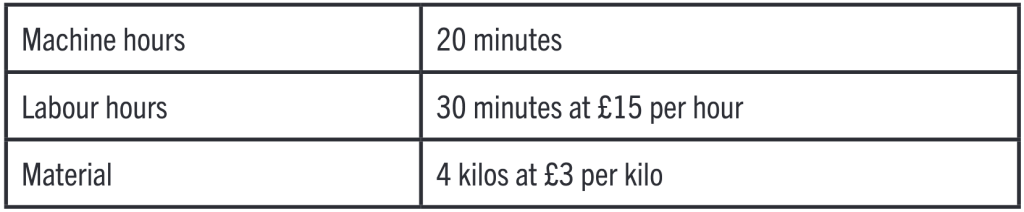

ABC Limited have provided you with the following information relating to making one of their product units:

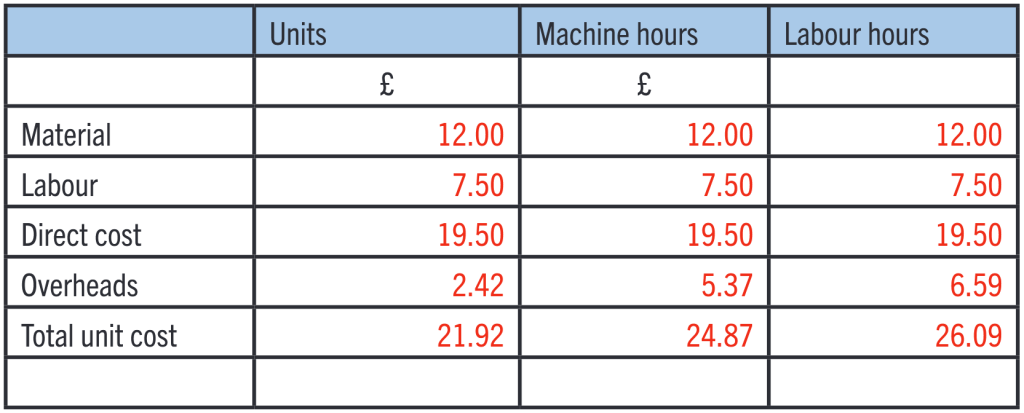

Using the overhead rates calculated earlier, complete the total unit cost, using the data above:

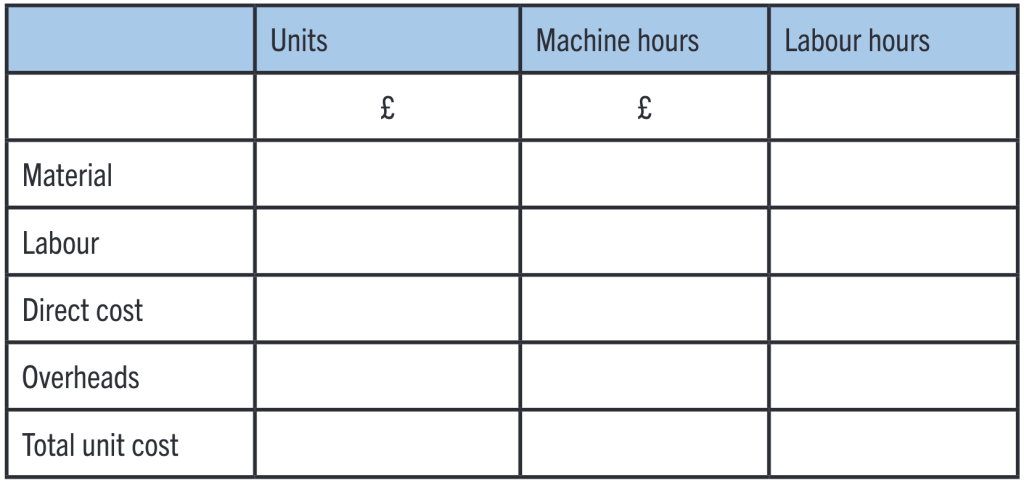

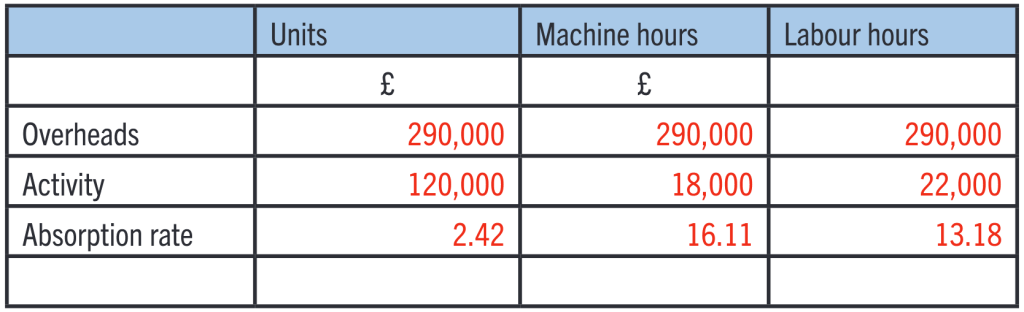

Answer

Calculations:

Overheads £290,000 / 120,000 = £2.42

Machine hours £290,000 / 18,000 = £16.11

Labour hours £290,000 / 22,000 = £13.18

Calculations:

Material 4 kilos x £3 per kilo = £12.00

Labour hours £15 / 60 minutes x 30 minutes = £7.50

Overheads:

Units £2.42 calculated earlier

Machine hours £16.11 / 60 minutes x 20 minutes = £5.37

Labour hours £13.18 / 60 minutes x 30 minutes = £6.5

- Karen Groves is an AAT tutor and AAT Faculty Director at e-Careers